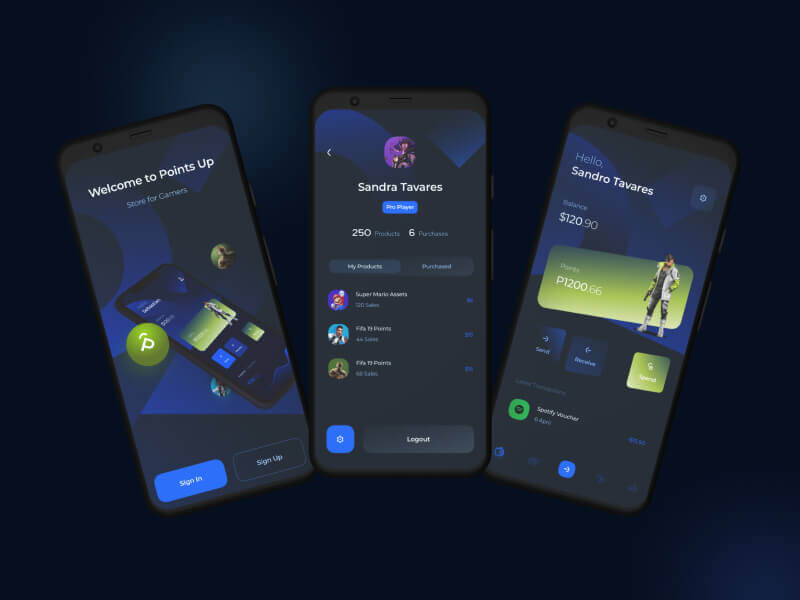

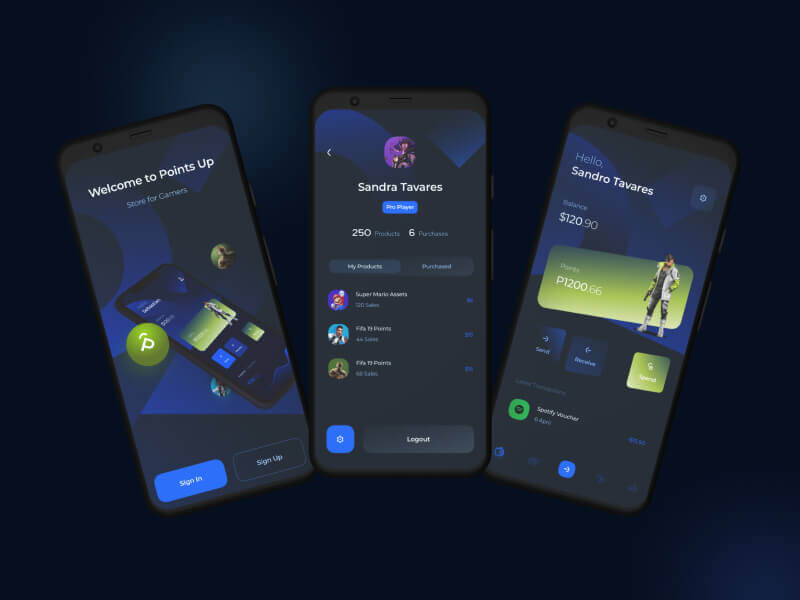

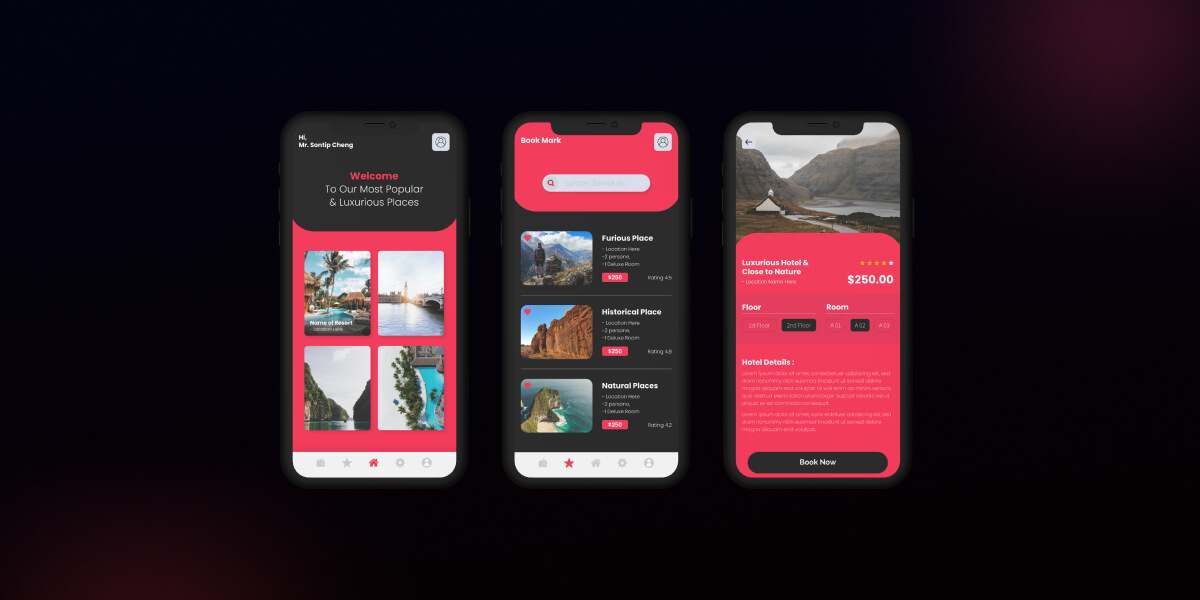

NFT Dashboard Application Development.

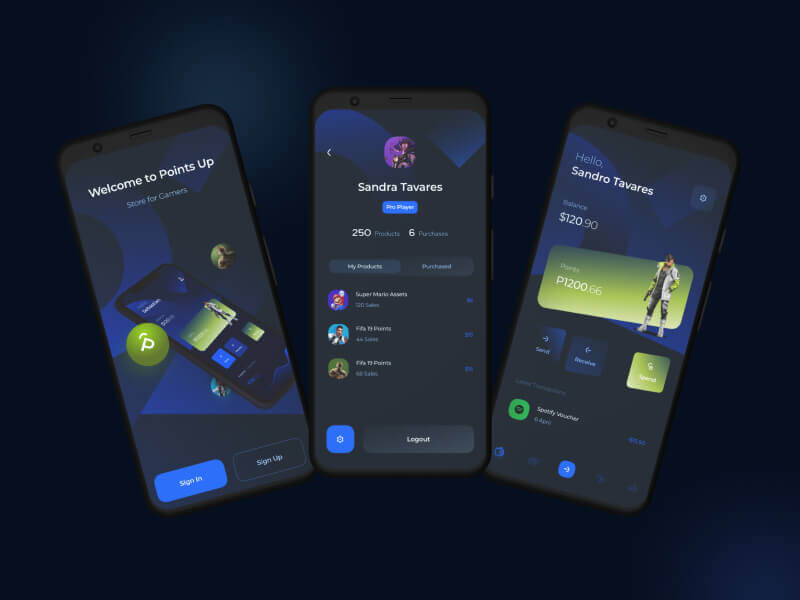

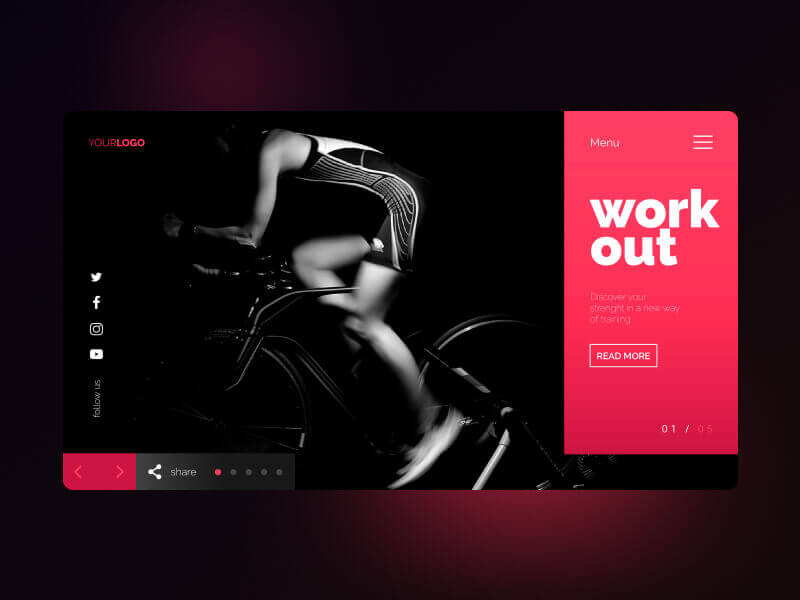

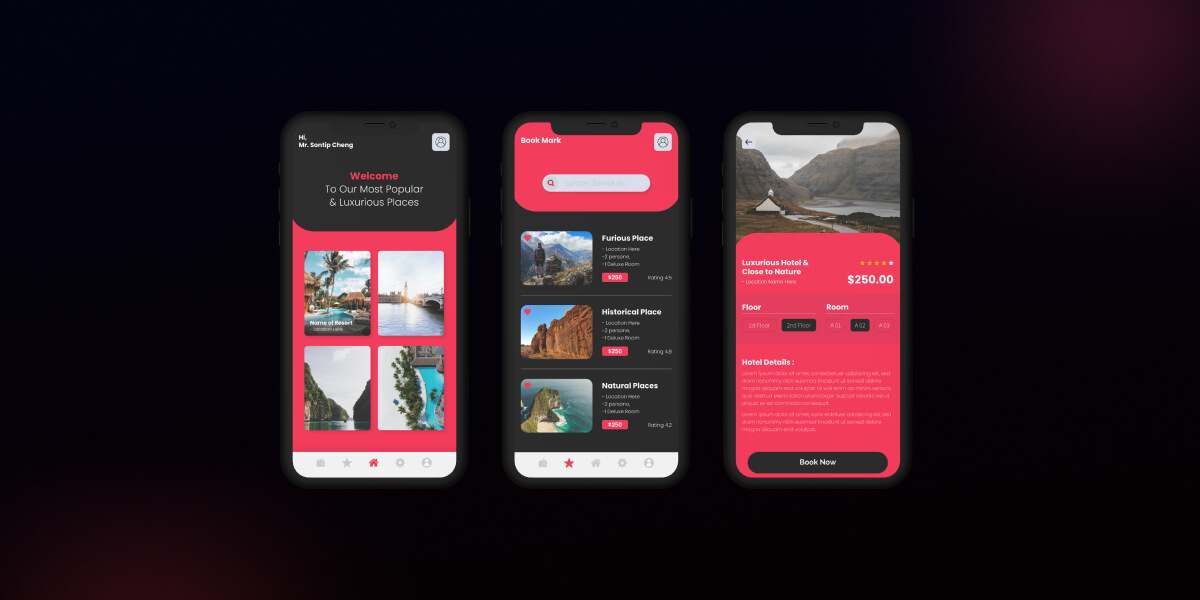

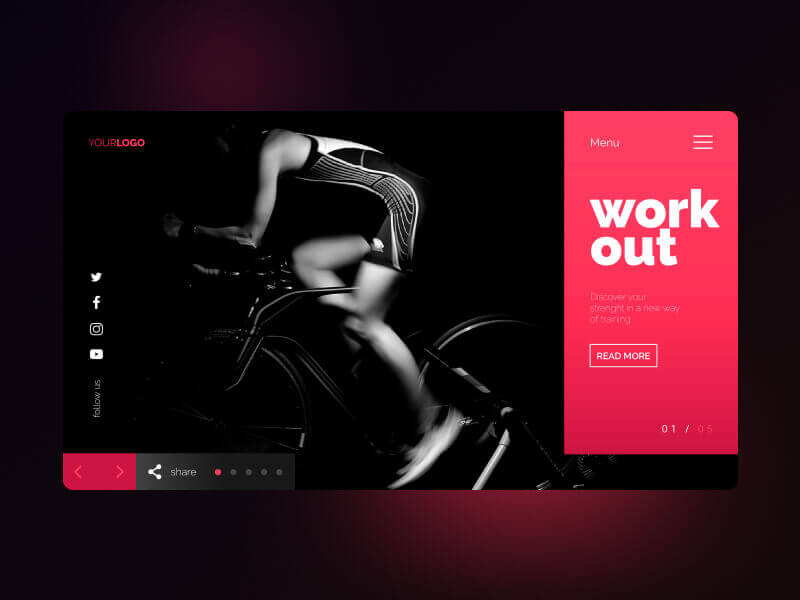

Through a wide variety of mobile applications, we’ve developed a unique visual system.

- Client George Wallace

- Date 15 June 2022

- Services Web Application

- Budget $100000+

Me Chamo Gustavo Camilote, e tenho mais de 9 anos de experiência com captação e edição de vídeos. Meu objetivo é ajudar empresas, criadores de conteúdo e infoprodutores à criarem mais autoridade no mercado, divulgar seus produtos, diminuir seu custo de aquisição de clientes (CAC) e aumentar seu faturamento, através da produção e divulgação do conteúdo em vídeo.

Capture a essência da sua mensagem com qualidade profissional. Utilizando equipamento próprio e flexibilidade para gravar tanto na sua empresa, quanto em estúdios profissionais, eu vou te ajudar a gravar a sua mensagem ou história com Alta qualidade sonora e visual.

Criarei vídeos impressionantes e envolventes que vão destacar seu conteúdo, tornando-o mais atrativo e profissional. Seja para sua empresa, canal de YouTube, redes sociais ou cursos online, a edição de vídeos é uma peça-chave para transmitir sua mensagem com impacto e profissionalismo

Entre no mundo dos podcasts com qualidade e estilo. Vou ajudá-lo a criar podcasts de alta qualidade que vão envolver seu público e gerar mais visibilidade para seu negócio. Desde a gravação, até a edição e mixagem , vou garantir que seu podcast tenha um som profissional e envolvente.

Maximize sua presença online, transformando seu conteúdo em diferentes formatos, como vídeos curtos, teasers e muito mais. Com uma estratégia de multiplicação de conteúdo, você poderá atingir um público maior e diversificado, aumentando sua visibilidade e autoridade no mercado.

Transforme seu conhecimento em produtos digitais de alto valor. Vou ajudá-lo a criar aulas para cursos online, webinars e outros tipos de produtos digitais em vídeo que vão atrair seu público-alvo e gerar receita. Vou garantir que seu infoproduto seja de alta qualidade visual, atraente e eficaz na transmissão do seu conhecimento.

Alcance o topo dos resultados de pesquisa com vídeos otimizados para SEO. Vou ajudá-lo a aumentar a visibilidade dos seus vídeos nos resultados de pesquisa do Google e do YouTube. Através de estratégias avançadas de SEO vou garantir que seu conteúdo em vídeo seja encontrado pelo seu público-alvo, gerando mais tráfego e oportunidades de negócio.

Through a wide variety of mobile applications, we’ve developed a unique visual system.

There are always some stocks, which illusively scale lofty heights in a given time period. However, the good show doesn’t last for these overblown toxic stocks as their current price is not justified by their fundamental strength.

A strategy is a general plan to achieve one or more long-term. labore et dolore magna aliqua.

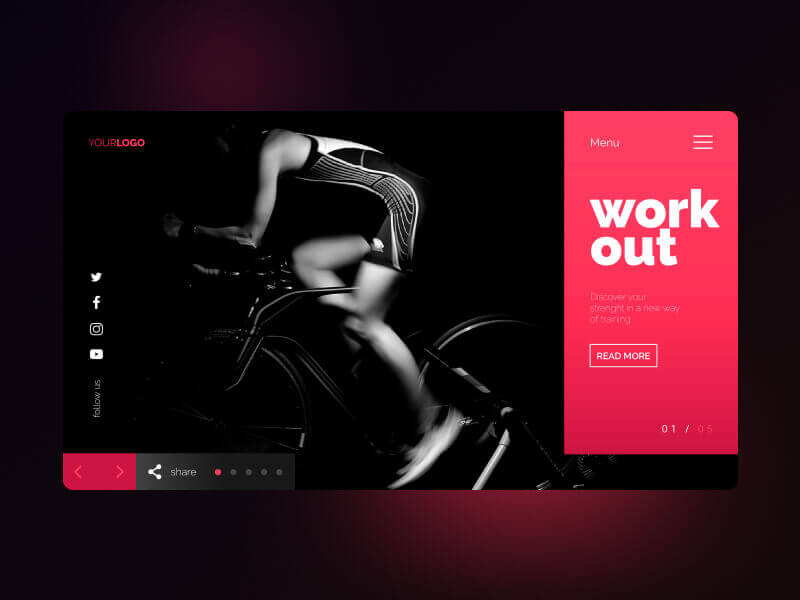

UI/UX Design, Art Direction, A design is a plan or specification for art. which illusively scale lofty heights.

User experience (UX) design is the process design teams use to create products that provide.

Toxic companies are usually characterized by huge debt loads and are vulnerable to external shocks. Accurately identifying such bloated stocks and getting rid of them at the right time can protect your portfolio.

Overpricing of these toxic stocks can be attributed to either an irrational enthusiasm surrounding them or some serious fundamental drawbacks. If you own such bubble stocks for an inordinate period of time, you are bound to see a massive erosion of wealth.

However, if you can precisely spot such toxic stocks, you may gain by resorting to an investing strategy called short selling. This strategy allows one to sell a stock first and then buy it when the price falls.

While short selling excels in bear markets, it typically loses money in bull markets.

So, just like identifying stocks with growth potential, pinpointing toxic stocks and offloading them at the right time is crucial to guard one’s portfolio from big losses or make profits by short selling them. Heska Corporation HSKA, Tandem Diabetes Care, Inc. TNDM, Credit Suisse Group CS,Zalando SE ZLNDY and Las Vegas Sands LVS are a few such toxic stocks.Screening Criteria

Here is a winning strategy that will help you to identify overhyped toxic stocks:

Most recent Debt/Equity Ratio greater than the median industry average: High debt/equity ratio implies high leverage. High leverage indicates a huge level of repayment that the company has to make in connection with the debt amount.

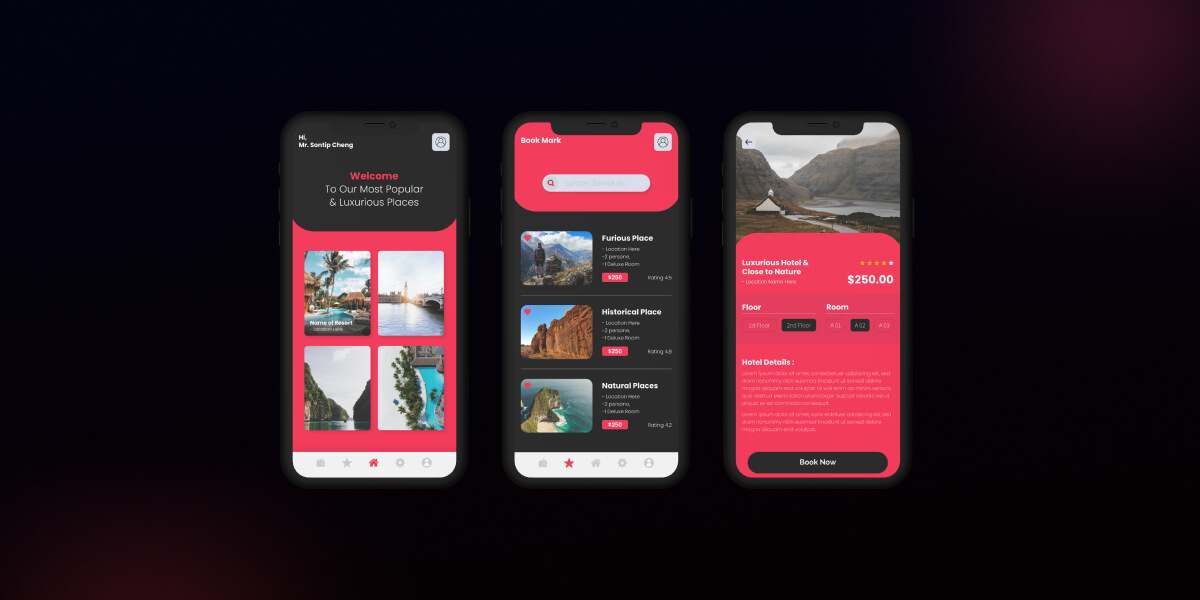

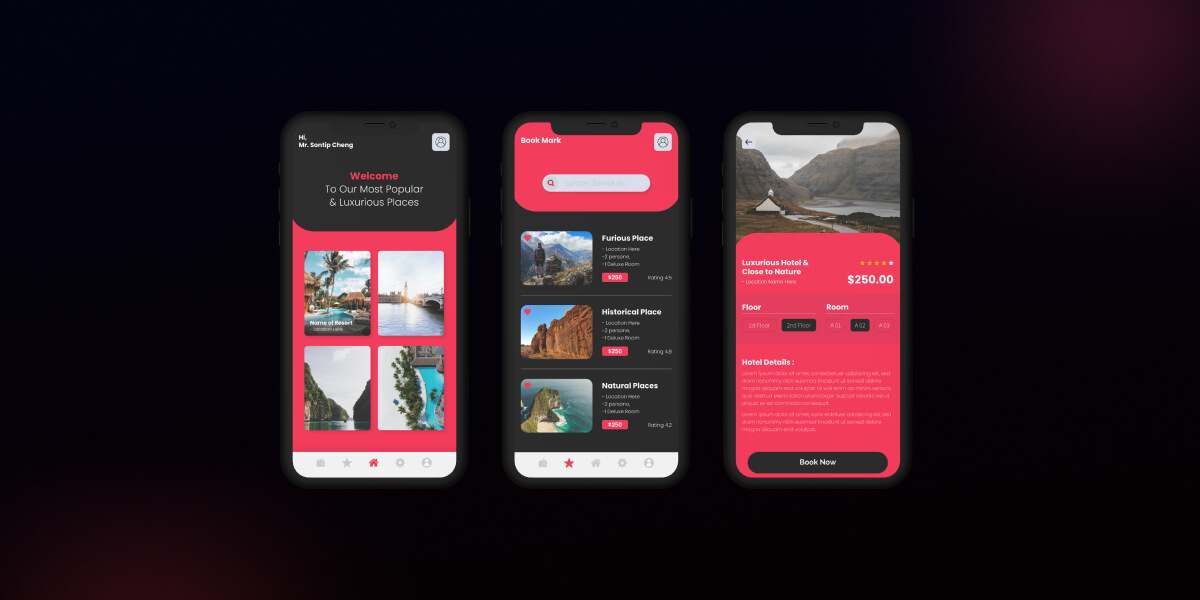

Through a wide variety of mobile applications.

UI/UX Design, Art Direction, A design is a plan or specification for art viverra maecenas accumsan.

Through a wide variety of mobile applications, we’ve developed a unique visual system and strategy that can be applied across the spectrum of available applications.

Most recent Debt/Equity Ratio greater than the median industry average: High debt/equity ratio implies high leverage. High leverage indicates a huge level of repayment that the company has to make in connection with the debt amount.

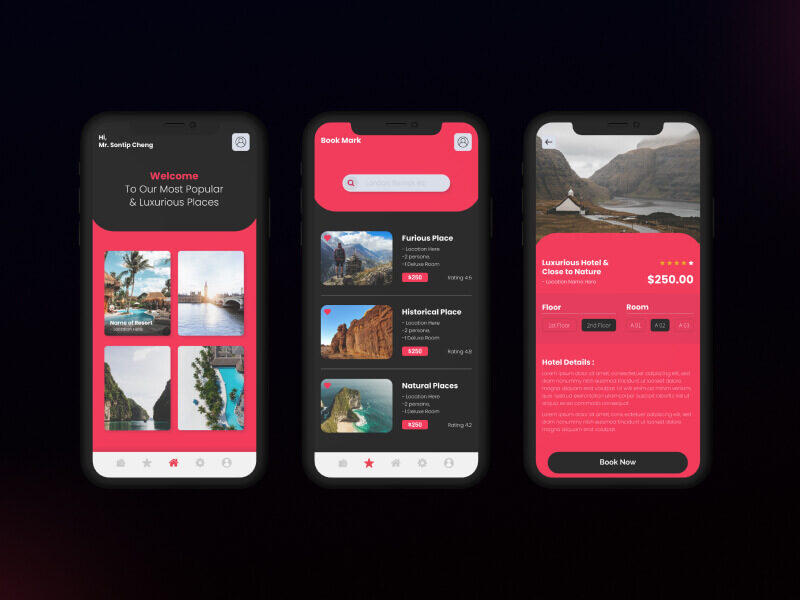

Through a wide variety of mobile applications, we’ve developed a unique visual system and strategy that can be applied across the spectrum of available applications.

A strategy is a general plan to achieve one or more long-term.

UI/UX Design, Art Direction, A design is a plan or specification for art.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Quis ipsum suspendisse ultrices gravida. Risus commod viverra maecenas accumsan lacus vel facilisis. ut labore et dolore magna aliqua.

There are always some stocks, which illusively scale lofty heights in a given time period. However, the good show doesn’t last for these overblown toxic stocks as their current price is not justified by their fundamental strength.

Toxic companies are usually characterized by huge debt loads and are vulnerable to external shocks. Accurately identifying such bloated stocks and getting rid of them at the right time can protect your portfolio.

Overpricing of these toxic stocks can be attributed to either an irrational enthusiasm surrounding them or some serious fundamental drawbacks. If you own such bubble stocks for an inordinate period of time, you are bound to see a massive erosion of wealth.

However, if you can precisely spot such toxic stocks, you may gain by resorting to an investing strategy called short selling. This strategy allows one to sell a stock first and then buy it when the price falls.

While short selling excels in bear markets, it typically loses money in bull markets.

So, just like identifying stocks with growth potential, pinpointing toxic stocks and offloading them at the right time is crucial to guard one’s portfolio from big losses or make profits by short selling them. Heska Corporation HSKA, Tandem Diabetes Care, Inc. TNDM, Credit Suisse Group CS,Zalando SE ZLNDY and Las Vegas Sands LVS are a few such toxic stocks.Screening Criteria

Here is a winning strategy that will help you to identify overhyped toxic stocks:

Most recent Debt/Equity Ratio greater than the median industry average: High debt/equity ratio implies high leverage. High leverage indicates a huge level of repayment that the company has to make in connection with the debt amount.

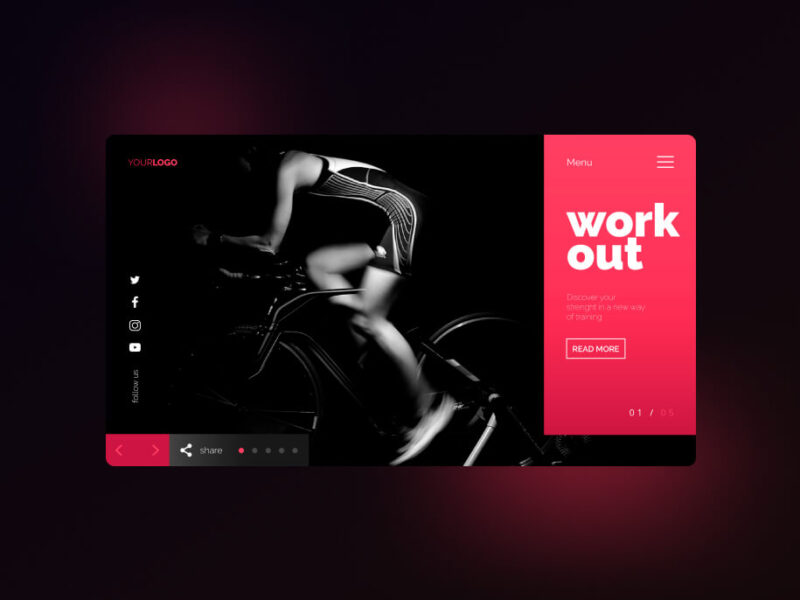

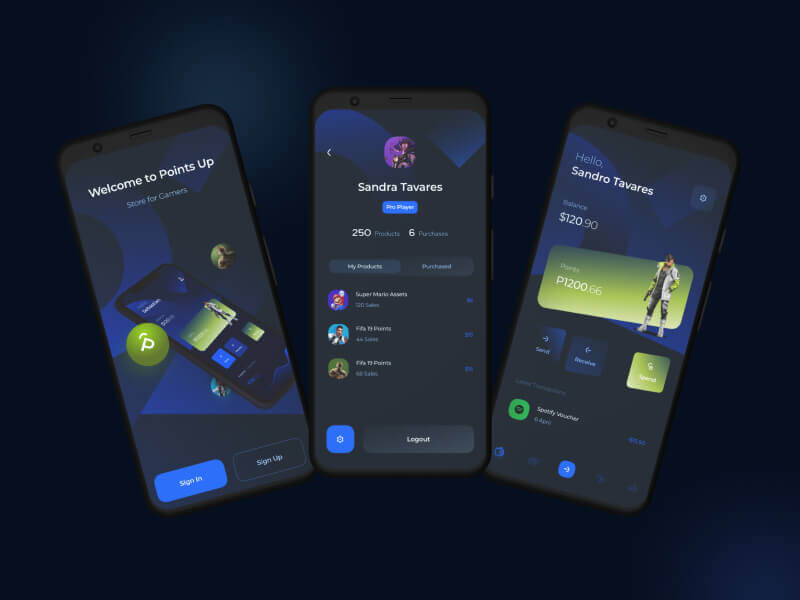

Through a wide variety of mobile applications, we’ve developed a unique visual system and strategy that can be applied across the spectrum of available applications.

A strategy is a general plan to achieve one or more long-term.

UI/UX Design, Art Direction, A design is a plan or specification for art.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Quis ipsum suspendisse ultrices gravida. Risus commod viverra maecenas accumsan lacus vel facilisis. ut labore et dolore magna aliqua.

There are always some stocks, which illusively scale lofty heights in a given time period. However, the good show doesn’t last for these overblown toxic stocks as their current price is not justified by their fundamental strength.

Toxic companies are usually characterized by huge debt loads and are vulnerable to external shocks. Accurately identifying such bloated stocks and getting rid of them at the right time can protect your portfolio.

Overpricing of these toxic stocks can be attributed to either an irrational enthusiasm surrounding them or some serious fundamental drawbacks. If you own such bubble stocks for an inordinate period of time, you are bound to see a massive erosion of wealth.

However, if you can precisely spot such toxic stocks, you may gain by resorting to an investing strategy called short selling. This strategy allows one to sell a stock first and then buy it when the price falls.

While short selling excels in bear markets, it typically loses money in bull markets.

So, just like identifying stocks with growth potential, pinpointing toxic stocks and offloading them at the right time is crucial to guard one’s portfolio from big losses or make profits by short selling them. Heska Corporation HSKA, Tandem Diabetes Care, Inc. TNDM, Credit Suisse Group CS,Zalando SE ZLNDY and Las Vegas Sands LVS are a few such toxic stocks.Screening Criteria

Here is a winning strategy that will help you to identify overhyped toxic stocks:

Most recent Debt/Equity Ratio greater than the median industry average: High debt/equity ratio implies high leverage. High leverage indicates a huge level of repayment that the company has to make in connection with the debt amount.

Through a wide variety of mobile applications, we’ve developed a unique visual system and strategy that can be applied across the spectrum of available applications.

A strategy is a general plan to achieve one or more long-term.

UI/UX Design, Art Direction, A design is a plan or specification for art.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Quis ipsum suspendisse ultrices gravida. Risus commod viverra maecenas accumsan lacus vel facilisis. ut labore et dolore magna aliqua.

There are always some stocks, which illusively scale lofty heights in a given time period. However, the good show doesn’t last for these overblown toxic stocks as their current price is not justified by their fundamental strength.

Toxic companies are usually characterized by huge debt loads and are vulnerable to external shocks. Accurately identifying such bloated stocks and getting rid of them at the right time can protect your portfolio.

Overpricing of these toxic stocks can be attributed to either an irrational enthusiasm surrounding them or some serious fundamental drawbacks. If you own such bubble stocks for an inordinate period of time, you are bound to see a massive erosion of wealth.

However, if you can precisely spot such toxic stocks, you may gain by resorting to an investing strategy called short selling. This strategy allows one to sell a stock first and then buy it when the price falls.

While short selling excels in bear markets, it typically loses money in bull markets.

So, just like identifying stocks with growth potential, pinpointing toxic stocks and offloading them at the right time is crucial to guard one’s portfolio from big losses or make profits by short selling them. Heska Corporation HSKA, Tandem Diabetes Care, Inc. TNDM, Credit Suisse Group CS,Zalando SE ZLNDY and Las Vegas Sands LVS are a few such toxic stocks.Screening Criteria

Here is a winning strategy that will help you to identify overhyped toxic stocks:

Most recent Debt/Equity Ratio greater than the median industry average: High debt/equity ratio implies high leverage. High leverage indicates a huge level of repayment that the company has to make in connection with the debt amount.

Tive a minha primeira experiência com o Gustavo ainda em 2018. Como a primeira impressão é a que fica, conto com seus trabalhos até hoje de gravação, edição e distribuição de conteúdos online. Gustavo além de conhecimento técnico, possui habilidade de poucos com uma câmera na mão! Se você está procurando produção de vídeos e crescimento em suas redes sociais, ele é o cara!

O Gustavo ajudou e tem ajudado muito na evolução do nosso podcast, a qualidade dos episódios do nosso podcast subiram de nível com o trabalho fantástico que ele faz. Além disso ajudou ele tá sempre disponível para tirar dúvidas, compartilhar sua visão do que é melhor para o projeto e qualidade e velocidade acima da média.

Estou disponivel para trabalhos individuais ou contratos mensais!

Telefone +55 19 9 7125-8894 E-mail: contato@camilote.com